Secretary’s Talk | Insisting on Upholding Integrity and Innovating to Improve the Efficiency of Supervision and Governance

The "Grey" Interest Chain of Micro-signal Underground Trading: the highest bid price is 500 yuan.

Recently, Wuhan police detected a fraud case, which caused concern.

The suspect invented a futures trading platform, pretending to be "Bai Fumei" to attract investors into the group. In the group chat, the profit news sent by "analysts", "forecasters" and "actuaries" was used to lure investors into real money. Police investigation found that the vast majority of participants in this chat group of more than 300 people were "childcare", and they "talked to themselves" in the form of one person controlling multiple micro-signals and staged a scam. After seeing through the routine, the police successfully recovered the victim’s 84 thousand yuan.

A survey by Beijing Youth Daily reporter found that behind the scam, there is an "underground" trading market of "buying and selling micro-signals". Some merchants use social media to peddle micro-signals, and divide the micro-signals they sell into different types, such as new number, old number, semi-real name and real-name binding payment software, with individual bids ranging from 58 yuan to 500 yuan. Behind the sale of micro-signals, it leads to "gray" interest chains such as fraud, illegal stock gambling and pornography.

case

"Affair" blessing cheated men out of their savings

Recently, Mr. He from Wuhan, Hubei Province, fell into a strange "affair". In mid-December 2018, a "beauty" netizen named "Love in Water" added his WeChat. During the chat, the "beauty" claimed to be a returnee, worked in a famous company with a good salary, and sent her own photos. Not long after we met, "Beauty" claimed to have a group that made money, and she was the beneficiary of the group, and offered to help Mr. He join the group and make money for him.

I can’t help but persuade Mr. He to go in and "observe and observe", but the news of investment profits in the group for several days has made Mr. He somewhat unable to hold back. Mr. He noticed that after one of the group friends "injected money" of 5,000 yuan, according to the "investment strategy" provided by the "analysts" and "forecasters" in the group, the income was more than 1,000 yuan in less than one minute.

After a few days of observation, Mr. He decided to give it a try. According to the account designated by the "analyst" in the group, he "injected money" of 10,000 yuan, and immediately received a profit of 1,840 yuan. Seeing the actual "income", Mr. He began to take the initiative to bet, but he lost his money several times. After five transfers, Mr. He spent his savings of 84,000 yuan. After discovering that he had no money to bet, the group owner kicked Mr. He out of the group chat. At the same time, the "beauty" who had close ties before also blacked out Mr. He. Only then did Mr. He realize that he had been cheated?

Mr. He then reported the case to the police. He said that on the one hand, he wanted to recover his losses, on the other hand, there were more than 300 people in the group, and he was worried that more people would be cheated.

detail

Deception routine: "One person is divided into many corners"

The police investigation found that Mr. He did encounter a scam. On the surface, the so-called "a social wealth group" that Mr. He joined seems to be composed of a group owner and members such as "analysts", "forecasters" and "actuaries". In fact, more than 99% of the members in the group are "childcare". They invented a trading platform, and these "child care" manipulated the backstage, and then lured the victims into the group with "Bai Fumei", so that they could see the illusion of "getting more money every day" and induce them to invest. The police investigation also found that only Mr. He was deceived in the group at present.

On January 2 this year, the police handling the case successfully recovered 84,000 yuan from the swindlers and forcibly dissolved the fraud group of 300 people. At present, the case is being further explored.

A few days ago, the reporter of Beiqing Daily further learned from the police that behind Mr. He’s scam, there is a hidden interest chain of buying and selling micro-signals and using social media to cheat. Some suspects create a high-yield illusion and commit fraud by mastering multiple micro-signals by one person, building a group, participating in group chats, and "talking to themselves".

visit

The micro-signal bid price is 58-500 yuan.

The reporter of Beiqing Daily searched for relevant keywords and found that there were many posts on social media that bought and sold micro-signals at high prices, and left contact information. The reporter randomly contacted several merchants. Some merchants bid 65 yuan to sell the "11-month-old (WeChat) number", and some merchants claimed that they had hundreds of micro-signals in their hands, which were divided into new numbers, old numbers, semi-real names and real-name binding bank cards, payment software and other different types, and the unit price ranged from 58 yuan to 500 yuan.

According to the merchant, the micro-signal it sells is not a computer robot, "but a micro-signal left after being registered with a mobile phone and then unbound". You can log in and use it directly by entering your account number and password. The reporter of Beiqing Daily said, "Need to build a group and be convenient ‘ One person adorns many corners ’ Consult the merchant on the grounds of mastering multiple micro-signals, and the merchant suggests that multiple micro-signals can be purchased and used at the same time. He also reminded that in order to prevent being blocked, attention should be paid to "Don’t use mobile phones ‘ More open ’ " , ensure that a mobile phone only logs in to one account. But he added, "Computers can ‘ More open ’ There is no problem in opening dozens to 100, and one by one when you close it. "

"If it involves collection and transfer, you can also buy a semi-real name or a real name card number from me." According to the merchant, the semi-real name number has a limit on the transfer amount, but the real name number does not, so the price difference between the two is large, and the more expensive the micro-signal transfer function is, the more complete it is. "The unit price of the semi-real name number is 168 yuan, and the unit price of the real name is 268 yuan." The merchant also revealed that most of the buyers who bought micro-signals from him were "playing stocks" and "gambling", but he did not respond to what he used to do after the purchase and whether it involved fraud.

After paying 58 yuan, the reporter of Beiqing Daily bought a micro-signal for testing. After entering the account number and password, a verification page pops up, which needs to be verified by SMS or QR code scanning. According to the guidance of the merchant, after sending the screenshot of the QR code to the merchant, the new number quickly passed the verification through the operation of the other party. The reporter observed that the new number is the same as the micro-signal applied by users themselves. You can add friends, build a group, and compile a circle of friends, but you can’t receive red envelopes and transfer money.

survey

There is a "gray" interest chain behind buying and selling

According to a survey conducted by the reporter of Beiqing Daily, a "gray" interest chain is often hidden behind the transaction of buying and selling micro-signals. A person in the gaming industry who did not want to be named explained that he bought the micro-signal because "it is necessary to transfer money frequently on WeChat every day, and in order to attract guests, he often makes some illegal and illegal contents in a circle of friends or in groups." The source said, "Micro-signals are often seized, so there must be multiple spare micro-signals in case of emergency."

There are also buyers who claim to buy the most micro-signals for more than one year. "Once they are sealed, they will be unsealed soon. The method of unsealing is to invite friends to make complaints, and unseal them as soon as possible, and wait for one month at the latest." Similar to the results of the visit of the reporter of Beiqing Daily, the buyers described that the price of the micro-signals they purchased was different according to the length of registration.

In recent years, it is not uncommon to resell micro-signals and fraud cases behind them. In June last year, the police in Huizhou City, Guangdong Province destroyed a "fabricated tragic life story to ‘ Tea girl ’ Identity fraud "gang. The criminal suspect used more than 330 computer mainframes, more than 2,300 mobile phones, more than 3,000 calling cards, 15 cat pond transmitters, inferior tea and bank cards and other crime tools to gain sympathy by fictional family background by committing crimes on WeChat account, and deceived the victim into buying inferior tea at a high price. After receiving the money, the "tea girl" blacked out the other party. In the end, the local police smashed six major activity dens, arrested 296 suspects and detained 239 suspects. According to police statistics, the case involved hundreds of millions of yuan, with more than 3,000 victims.

During the visit, the reporter of Beiqing Daily also found that the "selling micro-signals" on social media itself also had a scam. Many buyers exposed chat screenshots and merchant accounts afterwards, saying that they bought micro-signals online and were blacked out by the other party after adding merchant accounts for transfer. The amount of fraud of these victims ranges from 10 yuan to hundreds of yuan.

respond

Found illegal accounts will be closed in time.

Regarding the sale of WeChat accounts, lawyer Han Xiao of Beijing Kangda Law Firm pointed out that users have no right to sell their WeChat accounts, and other netizens are not allowed to buy other people’s WeChat accounts. Netizens who buy and sell WeChat accounts privately must bear the responsibility for breach of contract on the platform. He pointed out that if netizens who buy and sell WeChat accounts use these WeChat accounts for fraud, illegal stock gambling and other illegal activities, they also need to bear corresponding legal responsibilities.

At the same time, lawyer Han Xiao said that if WeChat, QQ and other platforms find that network users use network services to commit infringement, they should take necessary measures such as deleting, blocking and disconnecting links.

Regarding the phenomenon of hidden "gray" interest chains such as fraud and gambling behind "buying and selling micro-signals", the WeChat team replied last week that the scam encountered by Mr. He was similar to "stock recommendation fraud". In view of this situation, the WeChat team said that it will carry out special clean-up and continuous crackdown on illegal stock recommendation in accordance with relevant laws and regulations, Tencent WeChat Software License and Service Agreement and WeChat Personal Account Usage Specification, and restrict the group function of WeChat group, and impose stepped penalties on personal WeChat accounts such as restricting the use of functions or restricting login.

At the same time, for the "plug-in" behaviors such as logging in on one device at the same time, using multiple WeChat accounts, using WeChat plug-in tools to organize gambling platforms, maliciously guiding users to participate in gambling and collecting platform usage fees from them, the WeChat team said that it would deal with them according to the violation.

In addition, regarding illegal businesses using QQ search channels to "buy and sell micro-signals", the QQ security team said that QQ resolutely cracked down on any illegal activities such as "selling users’ personal information", and after receiving the report, it would quickly block relevant search keywords and block illegal QQ groups and accounts.

As of the evening of January 10th, the QQ group, personal QQ account and micro-signal, as well as gambling and WeChat group suspected of soliciting, which were discovered by reporters of Beiqing Daily, have been seized.

Text/reporter Zhang Ya Intern Zhang Yulin

Editor-in-Chief/Chi Haibo

The new release of Shengsi MindSpore 2.3 | Shengsi Artificial Intelligence Framework Summit 2024 was successfully held.

As the root technology of software, artificial intelligence framework has become the core force to accelerate the development of artificial intelligence model and promote the development of industrial intelligence. The Shengsi Artificial Intelligence Framework Summit 2024, with the theme of "Rising for Wisdom, the Source of Innovation", was held at the Beijing National Convention Center on the 22nd, aiming at bringing together the innovative forces of the AI industry, promoting the continuous innovation of root technology, and building a new ecology of artificial intelligence open source.

As the mainstream open source framework in China, Shengsi MindSpore builds a vibrant developer community and is committed to promoting the progress of China’s artificial intelligence industry. In the past two years, open source framework products including Shengsi MindSpore have been developing continuously. IDC research shows that Shengsi MindSpore has made outstanding achievements in ecological construction.

He You, an academician of China Academy of Engineering and vice chairman of China Artificial Intelligence Society, said in his speech: China Artificial Intelligence Society has worked closely with Shengsi MindSpore, joined hands with Pengcheng Laboratory and Shengsi MindSpore to carry out the Academic Fund 2.0 project, accelerated the original academic innovation based on Shengsi and the publication of papers, brought the original force of academic talents into play, and combined with the technical originality of Shengsi, supported the prosperity of artificial intelligence industry with academic innovation.

Zhou Jun, president of Huawei ICTMarketing, said: The parallel computing ability, concise programming ability and convenient deployment ability of the AI framework have gradually become the key success factors of large-scale model training. Shengsi will continue to innovate and explore, focus on root technology, and use a more open technology system to enable partners and developers to achieve large-scale model innovation more flexibly and accelerate the application scale of large models.

JackDongarra, winner of the Turing Prize in 2021 and an outstanding professor of computer science at the University of Tennessee, shared the development trend of computing and framework. He pointed out that open source has many advantages in essence and can provide a better software foundation for the future. The development of MindSpore open source framework has promoted the improvement of software performance.

AIforScience new paradigm, generative AI-enabled aerodynamic shape design

Tang Zhigong, academician of China Academy of Sciences and chairman of China Aerodynamics Society, said: Based on MindSpore, the large model platform of generative aerodynamic design breaks the traditional design paradigm, and the design time is shortened from month level to minute level, which meets the requirements of conceptual design. In the future, the platform will be extended to aviation, aerospace, shipbuilding, high-speed rail, energy, automobiles and other industries, leading the leap-forward development of industrial equipment design and manufacturing capabilities.

Independent innovation and development of generative aerodynamic design large model platform based on Shengsi AI framework. In the model development stage, MindSporeFlow, a lifting framework and fluid mechanics suite, provides a comprehensive library of scientific computing algorithms and a general interface for the model, which improves the efficiency of model development. In the model training stage, using MindSpore multi-dimensional parallel interface, based on the computing power support of Chengdu Intelligent Computing Center, the model and data can be expanded efficiently; In the model deployment stage, the professional knowledge is integrated into the large model platform of aerodynamic design by using the Shengsi large model suite. Non-AI tools such as large language model, aerodynamic shape design model, aerodynamic prediction model and storm software are connected in series, and the aerodynamic design large model platform can support a variety of aerodynamic shape design scenarios.

Shengsi MindSpore2.3 is newly released, and the large-scale model development training is simpler, more stable and more efficient.

Shengsi MindSpore actively explores cutting-edge technologies and supports the original and efficient training of large models. Through eight parallel technologies, such as original multi-copy and multi-pipeline interleaving, the cluster linearity reaches 90% (less than 60% in the industry), and the computing power utilization rate reaches 55% (less than 40% in the industry) through the whole map optimization and sinking execution. Aiming at the common problems of high cluster failure rate and long recovery time, the failure recovery can be completed in 20 minutes by compiling snapshots and deterministic CKPT technology.

In the deployment of large-scale model, Shengsi realizes the unification of scripts, distributed strategies and runtime by upgrading the architecture of training and pushing, and the reasoning deployment of Baichuan2-13B takes only one day. In the large model reasoning, the reasoning throughput is improved by more than 2 times through LLMServing; Upgrade the model compression tool "Golden Hoop 2.0" to achieve 100 billion model compression to ten times.

In order to lower the development threshold, Shengsi continuously upgraded the MindSporeTransFormers large model suite, and provided MindSporeOne production suite. The whole process can be developed out of the box in one week.

Innovate the AI+ scientific computing paradigm and incubate the basic big model in the scientific field. MindSpore has been exploring AI bio-computing for many years, and has built an AI bio-computing suite with top scientific research institutions and partners, including more than 20 SOTA models such as protein structure prediction and generation, to accelerate innovation in related fields.

Facing the long-term planning, we will improve MindSpore’s deep-rooted technology and continue to evolve to help the big model industry land.

Four actions empower academics and ecology

Ding Cheng, chairman of Shengsi MindSpore Open Source Community, announced four actions of Shengsi Empowering Academics and Ecology at the conference. The Academic Thesis Fund 2.0, which cooperates with China Artificial Intelligence Society and Pengcheng Laboratory, will join hands with more than 50 global AI scholars in the next three years to explore new academic peaks and achieve double improvement in quantity and quality; Shengsi development board application innovation action, based on the orange development board, provides systematic cases, tutorials and support to help developers get started quickly, get started quickly and quickly create personalized applications; Shengsi accelerates the incubation of native big models, and supports more partners to move from Shengsi migration and adaptation to native development through incentives, special technical support and joint market promotion; Shengsi open source community internship activities, through code practice, let developers really practice and grow.

Awarded the outstanding contribution mentor and developer of Shengsi MindSpore.

As Gitee- the largest open source code hosting platform in China, open source China selected MindSpore as the "Best Open Source Contribution Project of Giee China". According to Giee Index 2.0, MindSpore performed well in various indicators and became the whole category index NO.1 under the Giee-AI field classification. Ma Yue, chairman of Open Source China, said: The ecological prosperity cannot be separated from the contribution of every project, and MindSpore is a treasure cherished by Gitee.

In March, 2020, Huawei launched the MindSporeAI framework. After opening the source, it received positive response from domestic and foreign developers, with tens of millions of visits, more than 6.87 million downloads and installations, ranking first in the code cloud open source project, with more than 5,500 service enterprises and 360 cooperative universities. Since 2023, more than 1,200 top conference papers have been published based on Shengsi framework, ranking first in China and second in the world among all AI frameworks, and it has become the most innovative and dynamic AI open source community in China.

This conference selected 10 "Outstanding Contribution Mentors of Shengsi MindSpore" and 15 "Outstanding Contribution Developers of Shengsi MindSpore" for their outstanding contributions to the community.

American rule-based international order: stealing six times a month

Foreign media pay attention! There is no need for China to manipulate the RMB exchange rate.

CCTV News:On July 31st, the International Sharp Review of China Central Radio and Television Station broadcasted an article entitled "There is no need for China to manipulate the RMB exchange rate", which was reprinted by many overseas media.

On July 31, Russian Siberian News Network, European Times German Network, German-Chinese Report website, Spanish Radio International website, Italian RADIOWE website (facebook, twitter), Portuguese Lisbon Rainbow FM website (facebook), Universal Iberian APP, Brazil Rio Headline China Radio Website (facebook), Brazil Sao Paulo World China Radio Website (facebook), Indian Daily Morning News website, Turkish Economic Observation Network, Radio Elshinta Indonesian website, Czech Today Information website, Tanzanian African Media Group facebook account, UAE Ain News Network, Cambodian media freshnews website, American Global Oriental Company official website, Chinese PT portal, Chinese headline APP, Portuguese news APP(facebook, twitter), Many overseas media such as Nordic Times website, European Union Chinese website, West Africa online website, Africa Times website, Europe-China United Times website, Greek China website, Japanese Chinese business website and so on have forwarded them one after another. On August 1st, Hong Kong Ta Kung Pao and Indonesia International Daily also published this article. The main reports are as follows:

In response to the recent unilateral accusation by the United States that China manipulated the RMB exchange rate, Maurice &bull, chief economist of the International Monetary Fund (IMF); Obst Feld recently told the American media: "We don’t have any evidence that China manipulates the currency."

In fact, "China’s exchange rate manipulation theory" is an old saying of the United States, which lacks objective basis and even goes against the direction of RMB exchange rate market-oriented reform. As Geng Shuang, a spokesman for the Ministry of Foreign Affairs of China, said, the RMB exchange rate is mainly determined by market supply and demand, and it fluctuates in both directions. China has no intention to stimulate exports through competitive devaluation of the currency.

According to the definition of IMF, "exchange rate manipulation" refers to a country’s long-term, large-scale and one-way intervention in its own exchange rate, which leads to the exchange rate being beneficial to its own trade and thus gaining illegitimate interests in trade.

Analysts pointed out that there are three main reasons why China has no motivation and necessity to manipulate the exchange rate to stimulate exports:

First, domestic consumption has become the dominant force in China’s economic growth. With the continuous upgrading of domestic production and household consumption, mid-to-high-end consumption will accelerate the economic transformation led by modern service industry, and the leading role of consumption in China’s economy will be further enhanced. There is no need for China to stimulate exports by intervening in the RMB exchange rate.

Second, opening wider to the outside world will provide solid support for RMB assets. With the deepening of opening up and the promotion of RMB internationalization, RMB assets are increasingly favored by overseas institutions.

Third, it is not worth the loss to intervene in RMB depreciation. Since the beginning of this year, China has launched a series of measures to further deepen its opening up and expand its imports. If it intervenes in RMB depreciation at this time, it will definitely increase the import cost, not to mention that the import growth rate of China’s goods trade is far higher than the export growth rate. Under this background, it is undoubtedly not worth the loss to adopt RMB depreciation strategy.

So, how should we view the recent fluctuation of RMB exchange rate?

First of all, it is related to the rising global risk aversion. The Trump administration’s trade protectionism has stimulated global risk aversion, affected the entire foreign exchange market, brought about repeated fluctuations in US stocks, increased market uncertainty, and continued decline in commodity prices. Recently, the RMB exchange rate fluctuated, which is more of an emotional performance of the market.

Second, it is related to the strength of the US dollar index. Judging from the situation in the first half of the year, the US dollar index rose by 2.45% as a whole, but in the same period, the central parity of RMB against the US dollar was only lowered by 1.67%, which was much lower than the increase of the US dollar index. Therefore, the fluctuation of RMB is a spontaneous "compensation and correction" behavior of the market under the warming of risk aversion.

Third, it is related to the Fed’s interest rate hike. Since April, the RMB has depreciated by more than 8% against the US dollar. During this period, US monetary policy is in the process of raising interest rates and shrinking its balance sheet. The Federal Reserve raised interest rates twice in March and June, and increased the number of interest rate hikes this year from three to four, and at the same time, cooperated with corresponding measures to shrink the table to recover liquidity. The Bank of China adheres to a prudent and neutral monetary policy, foreseeing pre-adjustment and fine-adjustment, and manages the general gate of money supply. To a certain extent, this round of RMB exchange rate fluctuation is a market behavior caused by the differentiation of monetary policies between China and the United States, and there is no intervention component.

As some analysts have pointed out, the recent fluctuation of RMB exchange rate has not exceeded the reasonable range, and the RMB is still relatively strong in the global currency. The two-way fluctuation of exchange rate is the result of market action. With China’s economy running well and foreign exchange supply and demand in balance, the RMB exchange rate is completely stable at a reasonable and balanced level at present and in the future. There is absolutely no need for China to interfere with the trend of RMB exchange rate.

A number of overseas media forwarded "International Sharp Review" articles:

Russian Siberian News Network forwarded on July 31, 2018

"European Times" German website forwarded on July 31, 2018

Italian RADIOWE website (facebook, Twitter) forwarded on July 31, 2018.

Portugal Lisbon Rainbow FM website (Facebook) forwarded on July 31, 2018.

Forward on July 31, 2018 by the website of Brazil’s Rio headlines (Facebook)

Turkish Economic Observer Network forwarded on July 31, 2018

India’s "Daily Morning News" website was forwarded on July 31, 2018

The Indonesian website of Radio Elshinta was forwarded on July 31, 2018.

Cambodian media freshnews website forwarded on July 31, 2018

Portuguese news APP(facebook, Twitter) forwarded on July 31, 2018.

Hong Kong Ta Kung Pao was published on August 1, 2018.

Indonesia’s International Daily was published on August 1, 2018.

Two departments: further promoting the standardized and healthy development of credit card business.

Cctv newsAccording to the website of China Banking and Insurance Regulatory Commission, China on July 7th, in recent years, the credit card business of China’s banking financial institutions has developed rapidly, which has played an important role in facilitating people’s payment and daily consumption. However, in recent years, some banking financial institutions have extensive credit card business philosophy, weak service awareness, inadequate risk management and control, and there are behaviors that harm the interests of customers. In order to promote the banking financial institutions to implement the new development concept, firmly establish the people-centered development idea, improve the quality and efficiency of credit card services to benefit the people and facilitate the people, effectively protect the legitimate rights and interests of financial consumers, and better support scientific and rational consumption with high-quality development, the People’s Bank of China Banking and Insurance Regulatory Commission and China recently issued the Notice on Further Promoting the Standardized and Healthy Development of Credit Card Business (hereinafter referred to as the Notice).

The Notice consists of eight chapters and thirty-nine articles, which are divided into strengthening the management of credit card business, strictly regulating the marketing behavior of card issuance, strictly controlling credit management and risk management, strictly controlling the flow of funds, comprehensively strengthening the standardized management of credit card installment business, strictly managing cooperative institutions, strengthening the protection of consumers’ legitimate rights and interests, and strengthening the supervision and management of credit card business. The main contents are:

The first is to standardize the collection of credit card interest fees. Some banking financial institutions have some problems, such as unclear disclosure of interest and fee levels, one-sided promotion of low interest rates and low rates, charging interest in disguised form in the name of handling fees, blurring the actual use cost, unreasonably setting too low a starting point for bill installment, and implementing automatic installment without customers’ independent confirmation, which makes it difficult for customers to judge the use cost of funds and even increase their interest and fee burden. The Circular requires banking financial institutions to effectively improve the standardization and transparency of credit card interest and fee management, strictly fulfill the obligation to explain interest and fee in the contract, show the highest annualized interest rate level in an obvious way, and continue to take effective measures to reduce the burden of customer interest and fee, and actively promote the reasonable decline of credit card interest and fee level. For credit card installment business, banking financial institutions are required to specify the minimum starting amount and the maximum amount, and uniformly display the cost of using funds for installment business in the form of interest, and shall not induce excessive use to increase customer interest fees by installment.

The second is to effectively strengthen the protection of consumer rights and interests. At present, consumer complaints in the credit card field mainly focus on nonstandard marketing propaganda, poor complaints, improper collection of customer information, improper collection and so on. Focusing on the outstanding problems reflected by the complaints from the masses, the Notice makes targeted regulations, requiring banking financial institutions: they must strictly state the legal risks and legal responsibilities involved in credit cards, and must not conduct fraudulent and false propaganda; Implement unified qualification identification for the bank’s credit card marketers, distribute certificates and show them to customers in advance. Complaints channels must be strictly announced to customers, and sufficient resources such as post personnel should be provided according to the number of complaints. We must strictly implement customer data security management and collect customer information through our own channels. The collection behavior must be strictly regulated, and the third party unrelated to the debt must not be collected.

The third is to change the extensive development model. Some banking financial institutions have unscientific business philosophy, blindly pursue scale effect and market share, and the situation of excessive card issuance and repeated card issuance is prominent, and the credit management and control are not prudent, which leads to disorderly competition, waste of resources and excessive credit granting. The Circular requires banking financial institutions not to use the number of cards issued and the number of customers as single or main assessment indicators, and banking financial institutions with a long-term sleep card rate of over 20% are not allowed to issue new cards. Reasonably set the upper limit of the total credit line of a single customer’s credit card. When approving and adjusting the credit line, the credit line accumulated by customers from other institutions shall be deducted.

The fourth is to standardize the management of external cooperation behavior. Some banking financial institutions have some problems, such as nonstandard credit card business cooperation behavior, inadequate management and control, and unclear boundary between rights and responsibilities of both parties. The Circular requires the headquarters of banking financial institutions to implement a unified list management of cooperative institutions, strictly manage the examination and approval standards and procedures, and not to carry out the core business links of credit cards through the Internet platform controlled by cooperative institutions. The credit card issuance and credit balance realized through a single cooperative institution should meet the concentration index limit. For the co-branded card business, the Notice prohibits banking financial institutions from exercising credit card business responsibilities directly or in disguised form by joint entities. The business scope of co-branded card cooperation is limited to the promotion and promotion of joint entities and the provision of rights and interests services in their main business areas.

The fifth is to further promote the convenience of credit card online services. The Notice encourages qualified banking financial institutions to actively adapt to the economic development and the upgrading of consumers’ financial needs, explore and develop online credit card business and other model innovations through pilot methods in accordance with the principles of controllable risks, safety and order, stimulate and shape new development dynamics, enrich credit card service functions and product supply, and continuously enhance people’s sense of acquisition, convenience and security in handling cards.

In the next step, China Banking and Insurance Regulatory Commission and the People’s Bank of China will urge banking financial institutions to seriously implement the requirements of the Notice, so as to promote the credit card industry to develop with high quality and better support scientific and rational consumption.

Notice of the People’s Bank of China, China Banking and Insurance Regulatory Commission, China on Further Promoting the Standardized and Healthy Development of Credit Card Business

Yin Bao Jian Gui [2022] No.13

All banking and insurance regulatory bureaus, Shanghai headquarters of China People’s Bank, branches, business management departments, city center branches of provincial capitals, sub-provincial city center branches, major banks, joint-stock banks, foreign-funded banks, non-bank payment institutions, China UnionPay Co., Ltd., Netlink Clearing Co., Ltd. and China Unicom (Hangzhou) Technical Service Co., Ltd.:

In order to standardize the business behavior of credit card business, implement the management responsibilities of banking financial institutions and their cooperative institutions, improve the quality and efficiency of credit card services, protect the legitimate rights and interests of financial consumers, adhere to the people-centered development idea, promote the high-quality development of credit card business and better support scientific and rational consumption, the relevant matters are hereby notified as follows:

First, strengthen the management of credit card business

(1) A banking financial institution shall formulate a prudent and steady credit card development strategy, which shall be reviewed and approved by its board of directors or senior management, and be continuously and effectively implemented and regularly evaluated and improved. Banking financial institutions shall reasonably formulate the annual management objectives and plans of credit cards in strict accordance with the development strategy.

(2) Banking financial institutions shall establish a scientific and reasonable credit card business performance evaluation index system and salary payment mechanism. The weight of compliance management indicators and risk management indicators should be significantly higher than other indicators. Banking financial institutions shall regularly assess and determine the positions and personnel scope that have an important impact on the credit card business risks, and implement strict management of deferred payment, recourse and deduction of performance pay.

(3) Banking financial institutions shall strictly implement the credit card asset quality classification standards and identification procedures to comprehensively, accurately and timely reflect the asset risk status. Strengthen the analysis of asset quality migration trend, set risk early warning indicators, continuously and effectively identify, measure, monitor, warn, prevent and dispose of risks, accurately grasp the scale and structure of non-performing assets, and timely dispose and write off them according to procedures.

(4) Banking financial institutions shall strictly implement the employee behavior management of credit card business, carry out continuous supervision and regular investigation, implement the whole process supervision of the business behaviors of important positions and key personnel, establish and improve the accountability and recording mechanism for illegal behaviors, and effectively monitor, identify, warn and prevent illegal behaviors of credit card business employees.

(5) Banking financial institutions shall strengthen compliance training and consumer rights protection training for their employees engaged in credit card business, and the total training time per person per year shall not be less than 30 hours.

Second, strictly regulate the marketing behavior of issuing cards.

(6) Banking financial institutions shall not directly or indirectly take the number of cards issued, the number of customers, market share or market ranking as single or main assessment indicators.

Banking financial institutions should continue to take effective measures to prevent risks such as fraudulent card handling and excessive card handling. Set the maximum number of cards issued by the institution for a single customer. Strengthen the dynamic monitoring and management of sleep credit cards and strictly control the proportion. The number of long-term sleep credit cards that have not been actively traded by customers for more than 18 consecutive months and the current overdraft balance and overpayment are zero shall not exceed 20% of the total number of cards issued by the institution at any time, except for credit cards with additional policy functions issued by banking financial institutions as required by policies and regulations. Banking financial institutions exceeding this ratio may not issue new cards. China Banking and Insurance Regulatory Commission can dynamically reduce the proportion limit standard of long-term sleep credit cards according to regulatory needs.

Banking financial institutions should respect the true wishes of customers when binding payment accounts and other accounts for credit cards, and provide unbinding services with the same convenience. If a customer applies for cancellation of a card, it shall complete the processing in time after confirming that there is no outstanding payment.

(seven) banking financial institutions to carry out credit card business should strengthen marketing publicity and management. When concluding a credit card contract with a customer, you should strictly fulfill the obligation of prompting or explaining the terms such as charging interest, compound interest, fees, liquidated damages and the contents of risk disclosure. Show customers the highest annualized interest rate level and the legal risks and liabilities involved in using credit cards in an obvious way to ensure that customers pay attention to and understand the terms. It shall actively inform customers of the consultation and complaint acceptance channels of the institution, as well as the credit card articles of association, the application form for credit card business signed by customers, and the inquiry channels of relevant contracts (agreements), and notify customers of repayment notice, overdue information reporting and other matters in the way agreed in the contract. When opening the online payment function of credit card for customers, we should fully fulfill the obligation of informing in advance, reach an agreement with customers on the terms of online payment, and obtain the customer’s confirmation and consent on the opening.

(8) Banking financial institutions shall actively take audio and video recording or other effective measures to completely and objectively record and save important information such as risk disclosure and information disclosure in key links such as identity verification of credit card customers and willingness to apply for a card, so as to ensure that the recorded information is comprehensive, accurate, tamper-proof and traceable, and can meet the requirements of supervision and inspection by financial management departments and investigation and evidence collection by judicial organs in China. The recorded information shall at least include: the valid identification materials of the credit card applicant, the financial status related to the credit card application, credit records, publicity and sales texts, credit card articles of association, signed contract (agreement), important tips and confirmation information, etc. The recorded information shall be kept for at least 5 years from the end of the client’s business duration.

(9) No person may engage in the credit card issuance marketing activities of a banking financial institution without the internal unified qualification certification. Banking financial institutions shall provide information inquiry methods for credit card marketers at their business outlets and electronic channels. Credit card marketers should present their work certificates containing the identity of the card issuer and personal work information to customers in advance, and inform customers of the information inquiry methods of credit card marketers.

(ten) banking financial institutions should implement strict management of credit card marketing behavior. Do not promise to issue cards or promise to give high credit; No fraud or false propaganda; Credit cards shall not be marketed by default check or forced bundling.

Third, strict credit management and risk control

(11) Banking financial institutions shall strengthen the credit review of credit card customers, understand and analyze the credit status of customers through legal channels such as the basic database of financial credit information, implement necessary multi-dimensional cross-verification, independently review and judge the identity of customers and identify the authenticity, completeness and timeliness of application materials. Customers who have multiple debt records in different institutions after investigation should be strictly examined to strictly guard against the risk of multi-head lending.

(12) A banking financial institution shall reasonably set the upper limit of the total credit line of a single customer according to the customer’s credit status, income status and financial status, and include the customer in all credit lines of the institution for unified management. Within the total credit line of credit card, the credit line of cash advance business shall not exceed the credit line of non-cash advance business. When issuing student credit cards, banking financial institutions shall implement the second repayment source in advance.

Banking financial institutions shall conduct full due diligence on a single customer and conduct consolidated management on all credit card credit lines of the customer in other institutions. In the process of credit approval and credit line increase (including temporary credit line increase), the accumulated credit lines obtained by other institutions should be deducted from the total credit line of the customer’s own credit card, and the situation of new card-issuing customers of this institution applying for credit cards in other institutions at the same time should be monitored and the corresponding credit line reduction should be implemented.

(13) Banking financial institutions shall implement strict and prudent dynamic management of credit line of credit card, and re-evaluate, calculate and determine the credit line of credit card customers at least once a year. For customers whose risk situation has deteriorated, monitoring and analysis should be strengthened, and measures such as reducing the credit line should be taken in time. If the customer’s credit line is raised, it shall be re-examined and approved, and the credit line shall not be raised without the customer’s consent. Banking financial institutions shall strictly set the approval authority for raising the credit line, and reasonably set the range, frequency, time interval and validity period of the temporary increase of the credit line.

(14) Banking financial institutions shall establish and improve the whole process management mechanism of credit card risk model development, testing, evaluation, application, monitoring, correction, optimization and withdrawal, ensure that the risk model development and evaluation links are independent of each other, and re-evaluate the risk model at least once a year and update and optimize it in time. When using the credit card-related risk models assisted by cooperative institutions, the principles of interpretability, verifiability, transparency and fairness shall be followed, and the risk model management responsibilities shall not be outsourced. The board of directors and senior management of banking financial institutions should understand the role and limitations of credit card-related risk models.

Fourth, strictly control the flow of funds

(15) Banking financial institutions shall take effective measures to timely and accurately monitor and control the actual use of credit card funds. Credit card funds shall not be used for repayment of loans, investment and other fields, and it is strictly forbidden to flow into areas restricted or prohibited by policies.

(16) Banking financial institutions, acquiring institutions and clearing institutions shall establish and improve the monitoring, analysis and interception mechanisms for abnormal card use behaviors such as cashing and swiping, and illegal fund transactions, take control measures for suspicious credit cards and suspicious transactions according to law, continuously and effectively prevent the risks of cashing and fraud, and prevent credit cards from being used for illegal and criminal activities. Record and save credit card transactions and other information completely according to law, and continuously meet the requirements of supervision and inspection by financial management departments and investigation and evidence collection by judicial organs in China.

(17) The acquiring institution shall accurately identify the transaction information in accordance with the requirements of relevant laws, regulations and rules, send it to the clearing institution completely and transmit it to the card-issuing banking financial institution, so as to facilitate the card-issuing banking financial institution to identify and judge risks and ensure the security of credit card transactions. Banking financial institutions shall display the trading information to customers completely and accurately according to the available trading information. If the received trading information does not meet the relevant provisions, they shall carefully evaluate and take necessary risk prevention measures. The clearing institution shall formulate and improve the rules for inter-agency payment business messages in accordance with regulations, and take necessary measures against member institutions that fail to report, misreport or falsify transaction information. Transaction information includes, but is not limited to, transaction time, transaction country, domestic and overseas transaction identification, trading places (including the name of online trading platform), transaction amount, transaction type, merchant name and category and other necessary information that truly reflects the transaction scenario. Personal sensitive information shall be protected by desensitization and other means.

Five, comprehensively strengthen the standardized management of credit card installment business.

(eighteen) banking financial institutions should strictly regulate the management of credit card installment business. To handle installment business for customers, we should set up independent application, approval and other links in advance, fully disclose the nature of installment business, handling procedures, potential risks and liability for breach of contract in a concise and easy-to-understand way, and confirm the knowledge by customers in a legally effective way. A separate contract (agreement) shall be signed with the customer for each installment business, and it shall not be confused with or bundled with other credit card business contracts (agreements). If the credit card installment funds need to be transferred to the customer’s own account, it shall be transferred to his own bank settlement account except the credit card, and the amount and term shall be managed according to the cash advance business.

(19) Banking financial institutions shall not re-stage the fund balance that has been staged, except for the personalized installment repayment agreement stipulated in the Measures for the Supervision and Administration of Credit Card Business of Commercial Banks (Order No.2 of China Banking Regulatory Commission in 2011). No minimum repayment service shall be provided for installment business. Do not only provide or check the option of charging full installment interest at one time by default.

(20) Banking financial institutions shall carefully set the amount and term of credit card overdraft by installment, and specify the minimum starting amount and the maximum amount of installment business. The term of installment business shall not exceed 5 years. If the customer really needs to apply for installment repayment for the cash advance business, the amount shall not exceed RMB 50,000 or the equivalent in a freely convertible currency, and the term shall not exceed 2 years.

(21) Banking financial institutions shall display all interest items, annualized interest rate levels and interest rate calculation methods that may be generated by installment business in an obvious way on the home page of installment business contract (agreement) and business handling page. When showing customers the cost of using the funds collected by installment business, interest shall be uniformly used, and the corresponding interest-bearing rules shall be defined, and no handling fees shall be used, unless otherwise stipulated by laws and regulations.

(22) If the customer settles the credit card installment business in advance, the banking financial institution shall charge interest according to the actual amount of funds occupied and the term, and charge fees according to the provisions of laws and regulations and the contract with the customer.

Sixth, strict management of cooperative institutions

(23) When conducting credit card business cooperation, banking financial institutions shall earnestly implement the main responsibility of business compliance review, and strengthen cooperation with cooperative institutions in employee compliance and consumer protection training. The credit card business management department of the head office or the headquarters of the credit card franchise institution shall formulate clear entry and exit standards and management approval procedures for the cooperative institutions, and implement list management. A written cooperation contract shall be signed with the cooperative institution to clearly stipulate the rights and responsibilities of both parties. If it is found that the cooperative institution provides unfair and unreasonable cooperation conditions or services, or fails to fulfill the obligation of transaction information transmission as agreed, it shall refuse to cooperate or terminate the cooperation according to the contract. The cooperative institutions mentioned in this Notice include, but are not limited to, various institutions that cooperate in credit card advertising promotion, payment and settlement, information technology, value-added services and collection.

(24) Banking financial institutions shall accept business links such as credit card application, customer information collection, identity verification, card issuance review and contract (agreement) signing through self-operated channels, and shall not implement them through internet platforms, pages or other electronic channels managed and controlled by cooperative institutions to ensure clear and accurate creditor-debtor relationship. Inquiries about the bill amount or the repayment amount through the channels managed and controlled by the cooperative organization shall obtain the separate consent of the customer and take necessary measures to ensure the personal information security of the customer. For consumers who apply for credit cards by transferring to the self-operated network platform of their own institutions through other cooperative institutions, the cooperative institutions shall be required to make special tips on the difference between the ownership subjects of the channels and places.

(25) If a banking financial institution obtains a credit card application through a single cooperative institution or a plurality of cooperative institutions with related relationships, the total number of approved credit cards issued shall not exceed 25% of the total number of credit cards issued by the institution, and the total credit line shall not exceed 15% of the total credit line of the institution. Except as otherwise provided by laws and regulations.

(26) Banking financial institutions shall assume the main responsibility for the operation and management of their co-branded cards, ensure that both parties to the co-branded cards present their own brands equally in all credit card-related business links, and shall not directly or in disguised form exercise banking duties on behalf of the co-branded units or substitute the brand of the co-branded units for the bank brand. We should continue to strengthen the analysis and monitoring of the business risk, reputation risk and other adverse effects of the joint venture, and strictly prevent the risk from being transmitted to this institution. Except for obtaining separate authorization from customers through the self-operated channels of the institution, it is not allowed to send back information unrelated to the rights and interests of the main business areas provided by the joint venture. It is not allowed to carry out business beyond the business area restrictions by issuing joint-name cards or through the channels of joint-name units. Strengthen cooperation with bank card clearing institutions, and establish and improve the business rules for issuing co-branded cards.

(twenty-seven) banking financial institutions should carefully and fully evaluate the matching degree between joint units and credit card product positioning. The joint unit shall be a non-financial institution that provides credit card customers with rights and interests services in their main business areas. Banking financial institutions shall not cooperate with financial institutions, non-bank payment institutions and local financial organizations to issue co-branded cards, except as otherwise provided by China Banking and Insurance Regulatory Commission.

(twenty-eight) the business scope of banking financial institutions to carry out joint card cooperation shall be limited to the promotion and promotion of joint units and the provision of rights and services in their main business areas. Where a joint venture provides data analysis, technical support, collection and other services, it shall sign a special contract separately, and stipulate the rights and responsibilities of both parties according to the principle of matching income and risk, and different cooperation content categories shall not be confused and cross-bound.

(29) If a joint unit directly or in disguised form participates in the credit card revenue or profit sharing in the co-branded card business cooperation, or improperly links the charging standard with the credit card overdraft amount and other indicators, the banking financial institution shall stop co-branded card cooperation with it.

(30) Banking financial institutions shall implement the main responsibility of collection management, strictly formulate and implement management systems such as audit inspection and complaint handling of collection business, standardize collection behavior, and shall not provide or disclose customer arrears information in violation of laws and regulations, and shall not collect debts from third parties unrelated to debts. Continuously strengthen the collection capacity building of this institution and reduce the dependence on outsourcing collection. Strengthen the management of outsourcing collection agencies. Banking financial institutions shall, at least in their official channels, uniformly disclose the name and contact information of entrusted collection agencies.

Vii. strengthening the protection of consumers’ legitimate rights and interests

(31) Banking financial institutions shall establish a review system and working mechanism for the protection of consumers’ rights and interests, and incorporate them into the credit card business risk management and internal control system. Regularly and strictly review credit card format contracts to avoid clauses and contents that infringe on consumers’ legitimate rights and interests.

(32) Banking financial institutions shall properly handle risk events and customer complaints in accordance with the principles of territorial management, graded responsibility and timely local settlement. Banking financial institutions shall be equipped with sufficient post personnel according to their business scale, business development trend and number of complaints, and ensure that they can fully obtain the authority and resources required for performing their duties.

(33) Under the premise of complying with laws and effectively covering risks, banking financial institutions should scientifically and reasonably determine the level of credit card interest fees according to the principle of marketization, effectively improve the quality and efficiency of services, and continue to take effective measures to reduce the burden of customer interest fees.

(34) Banking financial institutions shall strictly implement data security, personal information protection and other relevant laws and regulations and relevant provisions on credit management, follow the principle of "legality, justness and necessity", and clearly stipulate in the cooperation contract the purpose, manner and scope of the use of customer information by both parties, customer information confidentiality responsibilities and obligations, and effective measures to prevent and control the risk of customer information disclosure. It is not allowed to cooperate with institutions that conduct data processing in violation of laws and regulations.

Eight, strengthen the supervision and management of credit card business.

(35) China Banking and Insurance Regulatory Commission and its dispatched offices, the People’s Bank of China and its branches shall, in accordance with their statutory duties, strengthen the risk identification, monitoring, early warning, prevention and control and disposal of credit card business, and continuously strengthen the extended monitoring and standardization of various business activities related to credit card business. In violation of the provisions of this notice, it shall be ordered to make corrections within a time limit, and take relevant regulatory measures or impose administrative penalties according to the Banking Supervision Law of the People’s Republic of China, the People’s Bank of China Law of the People’s Republic of China and other laws, administrative regulations and relevant provisions.

(36) The Banking Insurance Regulatory Commission, in consultation with the People’s Bank of China, will promote innovation in the credit card industry in accordance with the principles of risk control, safety and order, and explore innovative modes such as online credit card business through pilot projects.

(37) China Banking Association and China Payment and Clearing Association shall give full play to the self-discipline function of the industry, continuously improve the self-discipline rules and risk evaluation system of credit card business, and strengthen self-discipline punishment and notification.

(thirty-eight) this notice shall come into force as of the date of promulgation. The transition period is 2 years from the date of implementation of this notice. If the stock business does not meet the requirements of this notice, it shall complete the rectification within the transition period, and complete the business process and system transformation in accordance with the requirements of this notice within 6 months. The new business after transformation shall meet the requirements of this notice.

(thirty-nine) this notice shall be interpreted by China Banking and Insurance Regulatory Commission in conjunction with the People’s Bank of China.

People’s Bank of China, China Banking and Insurance Regulatory Commission, China

July 7, 2022

Zhang Xin, a first-class model of the national public security system, participated in the investigation of major cases because of overwork and death.

CCTV News:On October 20th, due to overwork, Zhang Xin, a first-class hero model of the national public security system and a criminal investigation expert of the Ministry of Public Security, died unfortunately. He was only 58 years old this year.

source map

If you don’t know Zhang Xin, you may have heard of the "silver serial murder case". The simulated portraits of the three murderers involved were written by Zhang Xin. After more than 30 years as a policeman, he devoted himself to the study of simulated portrait technology. Through simulated portrait and analysis and reasoning, he helped local police to solve more than 800 major criminal cases and created miracles in the investigation of many criminal cases. Therefore, Zhang Xin is also known as the "magic pen and horse" in the criminal investigation field.

It is a very demanding job to restore the appearance of criminal suspects as much as possible by vague language description. In order to be able to draw the portrait closest to the suspect, Zhang Xin not only re-entered the Academy of Fine Arts for further study, but also walked around the streets regardless of commuting time, carefully observed the physical characteristics of all kinds of people and drew hundreds of thousands of sketches of all kinds of people.

Where there’s a will, there’s a way. With the maturity of Zhang Xin’s painting method, the number of cases solved by portraits has increased, and he has gained popularity in Shanghai and even the whole country, and the number of cases attracted by him has gradually increased. Among them is the "silver serial murder case".

Zhang Xin: "In my more than 30 years of working experience, it should be said that this means of committing crimes in this case is quite cruel, and it should be said that it has never been encountered for me. Another is that the time span of his crime is quite long, and the other span involves quite a lot of people. " "When I came into contact with these cases, it was unprecedented in difficulty."

Zhang Xin once said: "If you are strong, you will be strong." The greater the difficulty, the more motivated he will be. Although the time span is long, there are few witnesses, and what the witnesses saw in panic still has some conceptual consciousness. For example, witnesses described the suspect’s appearance as fierce and his smile as neurotic, which was a kind of crafty smile. Zhang Xin also needs to use a brush to express such a description with subjective imagination. He still has to discard the false and keep the true, distinguish which is subjective and which is objective, and consider the psychological feelings of witnesses. Every stroke of his is crucial, because it is providing a basis for the subsequent investigation. Should that sentence, the difference is a mile, and it is a thousand miles away.

Zhang Xin: "We say that different face shapes and different fatness are related to this person’s five senses. That is to say, a fat person like you can’t grow a thin nose, and a thin person can’t grow a fat nose. It is impossible for a narrow eyebrow frame to grow a big eye, so we still have to do it according to this scientific relationship, that is, a scientific law of different facial features and faces. Then that is to say, to discard the false and retain the true is to judge which descriptions are credible and which are subjective through the fat, thin and specific face shapes and widths she describes. "

It took Zhang Xin three days to complete these three portraits. You know, with his current skill, it only takes him ten minutes to an hour to draw a simulation. His time is spent on carving details, even a line on his face, a scar, etc., and even what special expressions will appear on the suspect’s face, which may bring important help to solving the case.

In order to draw a good simulation, he specially taught himself criminal psychology, criminal investigation, preliminary examination, trace inspection and so on. In order to do this job well, he devoted too much heart and energy, and the word responsibility was too heavy in his heart. No one thought that such a hero would leave us so early. While mourning, we also pay tribute to all the people’s policemen who struggled in the front line. I hope you will be safe! I hope this hero, Zhang Xin, has a good journey.

Big Data Forecast: Top Ten Congestion Scenic Spots during Mid-Autumn National Day Holidays

CCTV News:During holidays, congestion is easy to form around the scenic spots. According to traffic big data, there are ten congested scenic spots in the Mid-Autumn Festival of National Day.

Affected by the concentrated demand for holiday travel, during the "Eleventh" period, roads around some scenic spots will be prone to congestion and slow down. According to the traffic big data forecast, the top three scenic spots that are prone to congestion around roads are: Kaifeng City, with a daytime congestion delay index of 2.8, Wuhan Mulan Grassland with a daytime congestion delay index of 2.7, and Shenzhen Dameisha Seaside Park with a daytime congestion delay index of 2.6.

Citizens and tourists who drive by car in Beijing-Tianjin-Hebei region can choose routes such as Baili Landscape Gallery Line, G109 Beijing Section and G108 Beijing Section. Users in go on road trip in the Yangtze River Delta can choose S205 Provincial Highway (Tianhuangping Panshan Highway), Chunyang Line (Qiandao Lake Greenway) and South Anhui Sichuan-Tibet Line; If you choose the go on road trip route in Sichuan, you can choose the Jiuhuang Great Ring Road. The famous scenic spots Jiuzhaigou, Munigou Scenic Area, the First Bay of the Yellow River and Huanglong National Key Scenic Area are all distributed around the national provincial highway.

Comment on Exhibition | Viewing the Convergence of Shanghai Regional Art History from "Changchun in Ten Thousand Years"

![[yuan] [yuan]](https://baidubox-emoji.cdn.bcebos.com/imgs/%5B%E5%85%83%5D.png?r=2025100817) Written by Yang Weizhen and proofread by Zou Zhifang: Yang Weizhen Collection, Zhejiang Ancient Books Publishing House, 2017.

Written by Yang Weizhen and proofread by Zou Zhifang: Yang Weizhen Collection, Zhejiang Ancient Books Publishing House, 2017.![[yuan] [yuan]](https://baidubox-emoji.cdn.bcebos.com/imgs/%5B%E5%85%83%5D.png?r=2025100817) Dehui ed. Ji Li Martial Arts School: "Clean Rules and Regulations", Zhongzhou Ancient Books Publishing House, 2011.

Dehui ed. Ji Li Martial Arts School: "Clean Rules and Regulations", Zhongzhou Ancient Books Publishing House, 2011.![[Qing] [Qing]](https://baidubox-emoji.cdn.bcebos.com/imgs/%5B%E6%B8%85%5D.png?r=2025100817) Qian Qianyi: A Brief Biography of Poems of Dynasties, Shanghai Ancient Books Publishing House, 1959.

Qian Qianyi: A Brief Biography of Poems of Dynasties, Shanghai Ancient Books Publishing House, 1959.You and I have never thought of the most important factor that makes teenagers sick and disabled.

Original Pearl Krabs, Dr. Tagai Lilac

Apart from illness, what is the main cause of disability among children and adolescents?

The answer may surprise many people-

According to the report of the World Health Organization, the most important factor that causes illness and disability among teenagers is actually depression.

According to surveys and statistics, about 20% of children and adolescents worldwide have experienced depressive symptoms.

In China, this ratio is also close to the international level.

"Children have nothing to be depressed about? 」

"Don’t worry about food and clothing, what’s not happy? 」

Even if there are more and more news about depression among minors in recent years, many people still can’t accept it. Children are also depressed, and more and more surveys have confirmed that depression among children and adolescents is by no means an individual phenomenon. Its popularity is far beyond our imagination.

One out of every five children has depressive symptoms.

A study published in 2018 showed that the proportion of children and adolescents with depressive symptoms in China was 19.85%, and even reached 23.7% among children and adolescents in the central region.

That is to say, in China, one in every five children may have depressive symptoms.

Moreover, with the increase of age, the proportion of children and adolescents with severe depressive symptoms is also increasing.

Image source: Station Cool Hailuo

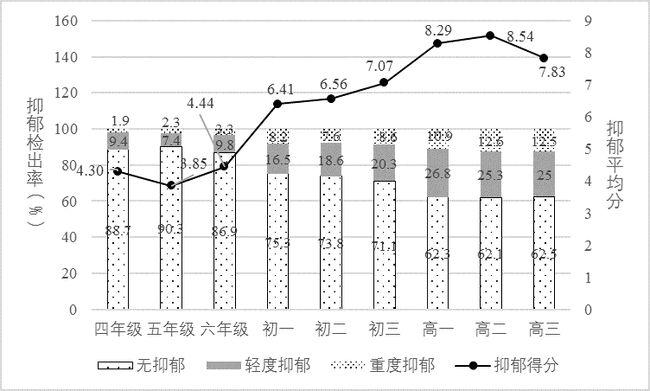

According to the National Mental Health Report (2019-2020) issued by the Institute of Psychology of Chinese Academy of Sciences, the detection rate of severe depression is only 1.9% ~ 3.3% among children in grades four to six of primary school, but among children in junior high school, the proportion rises to 7.6% ~ 8.6%.

Among high school children, the detection rate of severe depression is as high as 10.9% ~ 12.5%.

Image source: National Mental Health Report (2019-2020)

The survey also found that compared with primary school children, junior high school and senior high school children have higher average scores of depression and more serious overall depression.

However, along with the high detection rate and high depression level, there are extremely low medical visit rate and obvious delayed treatment.

A survey in the United States found that only 30% of minors with depressive symptoms were receiving treatment.

We didn’t find statistics on the proportion of children and adolescents in China, but in clinic, doctors found that it often takes one or two years from the time when children and adolescents appear symptoms to receiving treatment.

In other words, when the symptoms of depression first appear, it is difficult for children themselves, parents and teachers to realize that this is depression and seek help and medical treatment in time.

To a great extent, this is due to the depressive symptoms of children and adolescents, which are often not so typical.

Second, less typical symptoms of depression:

Rebellion, headache, stomachache

Different from the symptoms of adult depression, children and adolescents often have different manifestations of depression, and these manifestations are often misunderstood as other problems.

The child’s cry for help was ignored either rudely or carelessly.

1. Big temper and adolescent rebellion? No, it may be a symptom of depression.

Some studies have found that, unlike the common depression of adults, depression of minors is accompanied by impulsiveness and irritability, which seem less "depressed".

A follow-up survey of more than 1,400 minors found that 41.3% of the children diagnosed with depression showed irritability.

Moreover, boys seem to express their depression more often by losing their temper-73% of these irritable children are boys.

Image source: Station Cool Hailuo

2. Declining grades and not attending classes well? This may also be a symptom of depression.

Declining academic performance is also a common manifestation of depression in children and adolescents. Depression will affect children’s attention and energy, making it difficult for them to concentrate, doze off, or feel that they don’t understand, leading to a decline in their grades.

Some depressed children will show difficulties in going to school. For example, being late frequently, always failing to bring what you need for school, cut class or refusing to go to school, etc.

Many psychologists have found that depression is the emotional problem most closely related to school difficulties-children with school difficulties usually have obvious depression, and the greater the difficulties, the more serious the depression.

3. Always have a headache and stomachache? This may not be just a physical problem.

Another most common but easily overlooked manifestation of depression is the physical discomfort of children and adolescents.

Because children and adolescents are still in the mental growth stage, their ability to perceive emotions is not perfect. Compared with adults, it is more difficult for them to express emotions accurately and clearly. Therefore, emotions can often be released through physical reactions.

Complaining about physical discomfort is also the most commonly used way for children and adolescents to seek help when they experience depression.

According to the survey, children who come to pediatrics for various pains often have depressive symptoms.

Image source: Station Cool Hailuo

The most common is headache.

The survey found that one-third of children and adolescents who said they had headaches had the characteristics of depression; Of those children who were diagnosed with depression, 42% had a headache.

Children and adolescents who often complain about abdominal pain also have a high risk of depression.

The study found that when children feel abdominal pain every day, their risk of depression is close to 50%.

Compared with healthy children, children with depressive symptoms feel abdominal pain at a significantly higher frequency and intensity. Some researchers even suggested that abdominal pain is one of the most obvious differences between depressed children and healthy children.

In addition, dizziness, insomnia, loss of appetite, always feeling cold, allergies, etc. are all common physical symptoms of depressed children and adolescents.

However, in life, these symptoms are often not regarded as signals of depression, but lead to delayed treatment of depression. Parents spend a lot of energy to take their children for physical examination, but they don’t realize that these discomforts may be caused by psychological factors.

Studies have also shown that physical symptoms can lead people to lose sight of the truth behind depression: patients with physical symptoms usually experience a longer course of disease, receive less correct treatment and have a worse prognosis.

Image source: Station Cool Hailuo

In addition, the variability of children and adolescents’ depressive symptoms also increases their difficulty in identifying depressive symptoms.

The study found that:

When preschool children aged 3 ~ 5 are depressed, they may obviously lose interest in games;

Children aged 6-8 years may show more physical symptoms and complain about their discomfort; Or often shout and cry too much;

Children aged 9-12 are more likely to have low self-confidence, self-blame and run away from home.

Teenagers aged 12-18 will show academic problems or make reckless and reckless behaviors.

Because of such atypical and varied changes, people around you need to pay enough attention and sensitivity if they want to find the symptoms of depression in time.

But unfortunately, this concern and sensitivity may be exactly what children who suffer from depression lack in their lives. Even this lack increases their risk of depression.

Third, the "strict" education model in East Asia,

It is highly correlated with depression of minors.

Many parents feel that their children have nothing to think about, and it is impossible to be depressed without the pressure of food and clothing. All problems are problems of attitude and behavior.

"Look who they are, don’t they …"

"Find the reason from yourself."