Guo zhi fa ren zi [2021] No.38

Intellectual Property Offices of all provinces, autonomous regions, municipalities directly under the Central Government, cities under separate state planning, sub-provincial cities, Xinjiang Production and Construction Corps, Sichuan Intellectual Property Service Promotion Center and relevant local centers; All departments of China National Intellectual Property Administration Bureau, all departments of the Patent Office, the Trademark Office, other directly affiliated units of the Bureau and various social organizations:

The 14th Five-Year Plan for Intellectual Property Talents is hereby issued to you, please implement it carefully.

China National Intellectual Property Administration

December 31, 2021

The 14th Five-Year Plan for Intellectual Property Talents

In order to strengthen the construction of intellectual property talent team, stimulate the innovation vitality of the whole society, and provide talent support for building a world-class intellectual property power with China characteristics, this plan is formulated according to the Outline for the Construction of a Powerful Intellectual Property Power (2021-2035) and the National Plan for the Protection and Utilization of Intellectual Property Rights in the Tenth Five-Year Plan.

I. Planning background

Talent is an important indicator to measure a country’s comprehensive national strength and a strategic resource to realize national rejuvenation and win the initiative of international competition. Intellectual property talents are the first resource for the development of intellectual property, the prerequisite for the high-quality development of intellectual property, and the strategic support for the construction of a strong intellectual property country. With the continuous development of China’s intellectual property cause, China has embarked on a road of intellectual property development with China characteristics, and made historic achievements in intellectual property protection. The work of intellectual property talents has successfully completed the work objectives during the Thirteenth Five-Year Plan period, the institutional mechanism and policy environment for the development of intellectual property talents have been further optimized, and the national intellectual property talent team has grown rapidly, reaching 690,000, and the talent structure has become more reasonable. The "five batches" of talents in urgent need of intellectual property rights have been basically formed, the ability and quality of talents have been comprehensively improved, the implementation effect of talent engineering projects has been obvious, the talent evaluation mechanism has been continuously improved, and the intellectual property specialty has been added to the national economic title series, and remarkable progress has been made in the work of intellectual property talents. However, there are still some shortcomings and problems in the work of intellectual property talents, the work system of intellectual property talents needs to be further improved, the mechanism of intellectual property talents training, evaluation and incentive, and mobile allocation needs to be further improved, the structure of intellectual property talents is not optimized enough, the number of high-level intellectual property talents is insufficient, and the contradiction between supply and demand of intellectual property talents still exists to some extent.

The Tenth Five-Year Plan period is the first five years for China to start a new journey of building a socialist modernized country in an all-round way. In order to ensure a good start in building a strong intellectual property country, we have formulated and implemented the intellectual property talent plan during the Tenth Five-Year Plan period, trained a large number of high-quality intellectual property talents with both ability and political integrity with more active talent policies, clearer tasks and more powerful safeguard measures, and made the innovation vitality of all kinds of intellectual property talents compete with generate. Provide talent support for the completion of the "14th Five-Year Plan" for the protection and application of intellectual property rights in 2025, lay a talent foundation for the completion of the "Outline for the Construction of a Powerful Intellectual Property Country (2021-2035)" in 2035, and support the strategy of strengthening the country with talents in the new era.

Second, the overall requirements

(1) Guiding ideology.

Guided by Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era, we will thoroughly implement the spirit of the 19th National Congress of the Communist Party of China and the Second, Third, Fourth, Fifth and Sixth Plenary Sessions of the 19th National Congress, closely focus on promoting the overall layout of the "five in one" and the coordinated promotion of the "four comprehensive" strategic layout, adhere to the general tone of striving for progress while maintaining stability, base ourselves on the new development stage, implement the new development concept, build a new development pattern, and adhere to the theme of promoting high-quality development. In accordance with the spirit of the important instructions of the Central Talent Work Conference and the Supreme Leader General Secretary on attaching importance to the construction of intellectual property talents, we will continue to ensure the supply of intellectual property talents and innovate the development policy of intellectual property talents. Adhere to the Party’s overall leadership over talent work, create an environment of knowing, loving, respecting and using talents, gather talents from all over the world, cultivate and use talents in an all-round way, comprehensively improve the training, evaluation and growth system of intellectual property talents, and open up the whole chain of intellectual property talents work.

(2) Basic principles.

-Adhere to talents leading development. Give top priority to the development of human resources, regard intellectual property talents as the most basic, core and key factor in building a strong intellectual property country, raise the important position of intellectual property talents to a strategic height, vigorously build intellectual property talents, and strive to consolidate the talent base for intellectual property development, so as to push the construction of a strong intellectual property country to a new level.

-adhere to demand orientation. Focusing on the goal of building a strong country with intellectual property rights, we should be demand-oriented, improve the supply capacity of talents, do a good job in independent training of talents, maintain a scientific balance between supply and demand of intellectual property talents, and focus on solving key problems in the process of training and using intellectual property talents.

-Adhere to both quality and efficiency. Focusing on improving the ability, quality and use efficiency of talents, we should adhere to the combination of excellent increment and strong stock, improve the working system of intellectual property talents, implement policies, measures and engineering projects to improve the use efficiency of talents, and strengthen the deep connection and integration of talent training and talent evaluation.

-Adhere to systematic advancement. Make overall plans for the classified training, scientific evaluation, efficient use, rational flow and stimulating growth of intellectual property talents, combine overall planning with key promotion, integrate superior resources, and improve the systematic, holistic and collaborative level of intellectual property talents training in the new era.

(3) Main objectives.

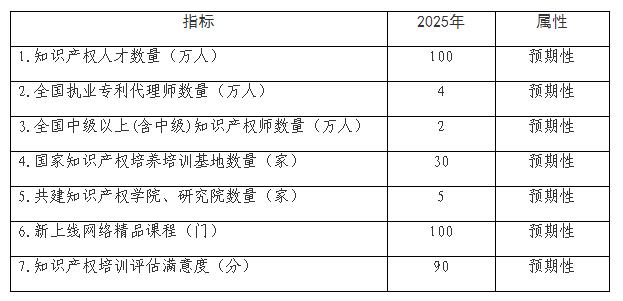

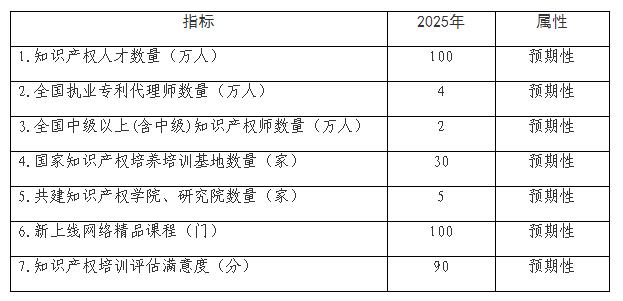

During the "14th Five-Year Plan" period, the overall goal of intellectual property talents’ work is to comprehensively integrate the working resources of intellectual property talents, improve the coordinated development mechanism of talents in all fields of intellectual property rights, promote the construction of intellectual property talents in the whole chain, and build and improve the intellectual property talents system that meets the needs of building a strong intellectual property country in the new era, so that talent training can meet all kinds of needs in all fields, links and levels of intellectual property rights. Strengthen the high-quality training of intellectual property talents, increase the supply of talents, improve the evaluation and incentive mechanism of talents, improve the efficiency of talent use, strive to create a high-end platform conducive to the growth and development of talents, and comprehensively improve the quality and level of talents. By 2025, the number of intellectual property talents will exceed 1 million, the number of high-level talents will further grow, the talent structure will be further optimized, and the effectiveness of talents will continue to increase.

Focusing on meeting the needs of all kinds of intellectual property talents, we will do a good job in building four key talent teams and one basic talent team. Build a professional and high-level intellectual property protection talent team with high political quality and strong business ability; Create a team of talents who can promote the capitalization and industrialization of intellectual property rights and use intellectual property rights efficiently; Cultivate a compound high-quality intellectual property public service talent team with disciplines such as science, engineering, management and law; Cultivate and select an international intellectual property talent team with international vision, rich international exchange experience and ability to handle international affairs. At the same time, strengthen the construction of basic talents at all levels such as intellectual property review and publicity.

Main indicators of intellectual property talents development during the "14th Five-Year Plan" period

III. Main tasks

(1) Strengthen the capacity building of intellectual property protection talents and push intellectual property protection to a new level. Accelerate the upgrading of the personnel capacity of the intellectual property administrative protection team, and increase the training and training of national and local intellectual property administrative protection personnel. Building a team of teachers for administrative protection of intellectual property rights. Strictly implement the system of appointment and qualification management for intellectual property administrative adjudication personnel, and carry out rotation training for certified personnel in the national intellectual property system to improve their ability and level of handling administrative adjudication cases. We will build a talent team of technical investigators for administrative protection of intellectual property rights, promote the establishment of a directory of intellectual property appraisers, and strengthen the cultivation of professional and technical capabilities.

Enrich the talent strength of intellectual property protection center, rapid rights protection center and rights protection assistance center. Improve the level of professional ability, optimize the talent selection mechanism and management incentive mechanism, increase the training of rapid pre-examination, rapid confirmation and rapid rights protection of intellectual property rights, promote the improvement of the ability and quality of rapid collaborative protection talents, and build a high-quality and compound talent team for intellectual property protection. Encourage and support public lawyers, patent agents, professional and technical personnel to participate in intellectual property mediation. Strengthen the professional training of intellectual property rights of mediators and other related talents.

(two) to improve the ability level of intellectual property rights, and promote the use of intellectual property rights to achieve new results. Optimize the training system of intellectual property operation talents, design progressive courses and carry out intellectual property operation training according to the concept of intellectual property operation based on the whole process of innovation. Guide the intellectual property operation service system to build key cities and strengthen the training of high-end operation talents. Improve the financial services capabilities of relevant institutions and personnel such as intellectual property pledge, insurance and securitization, and improve the level of intellectual property evaluation. Strengthen the construction of intellectual property talents in enterprises, guide local governments to carry out classified training for senior managers, intellectual property managers and intellectual property practitioners. Promote intellectual property talents in universities and scientific research institutions to improve their operational management capabilities, and substantially increase the number of intellectual property talents in universities and scientific research institutions. Strengthen the training of patent navigation talents, and gradually improve the work level of patent navigation talents. All regions should strengthen the construction of talent team in patent navigation service base, build a characteristic, standardized and effective patent navigation service system, and effectively play an important role in the innovation and development of patent navigation industry. Organize special training on the application of geographical indications and the cultivation of trademark brands, improve the comprehensive application ability of geographical indications and trademark brands, and help rural revitalization and brand economic development.

Improve the talent training system of intellectual property service industry to help innovation and development. Strengthen the construction of talent team in intellectual property service industry and cultivate top-notch talents in the industry. Enrich the training methods of talents in intellectual property service industry. Establish a talent exchange and cooperation mechanism to guide intellectual property service talents in developed areas to help underdeveloped areas. Strengthen the professional training of patent agents and professional training of trademark agents.

(3) Strengthen the training of intellectual property public service personnel and promote intellectual property services to a new level. With the concept of "full chain service, full chain service", we will cultivate a group of multi-level and high-quality intellectual property public service talents who can effectively serve the public and meet the needs of innovative subjects. Combined with the characteristics of public service institutions and regional needs, we will further enrich the public service talents of intellectual property public service backbone nodes and service outlets, and achieve full coverage of all kinds of intellectual property public service talents at the provincial level, with the coverage rate of prefecture-level cities reaching more than 50%. Strengthen hierarchical and classified training, strengthen the exchange and cooperation and sharing of intellectual property public service talents, and promote the rational flow and efficient gathering of talents.

Improve the overall management ability of intellectual property public services and continuously improve the efficiency of intellectual property public services. Strengthen the training of intellectual property information service talents, improve the talents’ abilities in intellectual property information management, information collection and processing, information retrieval and information analysis, information dissemination and utilization, and continuously expand the intellectual property information service talents of universities, scientific research institutions, library and information institutions, industry organizations and other network units, with the number of intellectual property information service talents reaching about 4,000. Strengthen the capacity building of window personnel in intellectual property business, vigorously cultivate "multi-functional" talents, and constantly improve the ability of window service personnel to "run all services through one window". We will continue to promote the construction of intellectual property network talents, improve the classified management, training, use, assessment and development guarantee mechanism of network talents, and promote the combination of independent training and talent introduction.

(4) Accelerate the upgrading of intellectual property internationalization talents’ ability and promote new progress in international cooperation in intellectual property. Implement the special training plan for international talents, and build an international talent training system with clear positioning, clear objectives, distinct levels, mutual connection and efficient operation. Strengthen the selection and training of international talents, such as expatriate international talents, foreign-related teachers of intellectual property rights, and international examiners, and improve the construction of talent pool. Promote the diversified development of international personnel training methods, make full use of training resources at home and abroad, and send personnel to participate in overseas (border) training programs. Actively explore international intellectual property training programs. Combined with the actual needs of Chinese enterprises’ outward development, we will carry out special training for international talents in the field of intellectual property operation and intellectual property agency, and strengthen the construction of talent teams such as international negotiation and overseas rights protection. Accelerate the knowledge update of international talents and encourage participation in the study of international rules of intellectual property rights. All regions should strengthen the training of international talents, cultivate a team of overseas professionals who are familiar with the rules of the international intellectual property system and have rich practical experience, and enhance the ability to deal with overseas intellectual property disputes.

Strengthen the international exchange of intellectual property talents. We will continue to provide an exercise platform for international talents training through the cooperation between the World Intellectual Property Organization, China, the United States, Europe, Japan and South Korea, the BRICS and the international cooperation projects of various bilateral platforms, help talents accumulate experience in international cooperation, improve their international cooperation capabilities, and cultivate, introduce and make good use of international talents in all directions.

(5) Strengthen the capacity building of basic intellectual property talents and constantly lay a solid foundation for intellectual property work.

Recruit, train, use, develop, manage and stabilize the registered talent team for intellectual property review. Formulate and implement a plan to improve the ability of patent examination talents, clarify the objectives and key points, and implement graded training. Strengthen the post training of patent examination talents. Establish an evaluation and feedback mechanism for the training effect of patent examination talents. Improve the recruitment and employment mechanism of trademark examiners. According to business needs, dynamically adjust staffing. Establish a training target system for trademark examiners. Explore the establishment of a hierarchical management system for trademark examiners. Construct an "expert" talent team composed of 100 people for trademark examination and hearing.

Strengthen the publicity of intellectual property rights and the construction of cultural talents. Cultivate a group of politically competent, high-quality, all-media, compound and expert intellectual property propaganda talents, strengthen the construction of propaganda ability, and focus on cultivating communication concepts, information content, technology application and communication ability. Train 1000 people in batches to publicize the national intellectual property system. Strengthen the publicity and education of intellectual property protection, and tell the story of intellectual property rights in China. Focus on training and selecting a group of primary and secondary school intellectual property teachers with rich teaching experience and solid professional skills. Strengthen the construction of intellectual property legal talents, and cultivate legal talents with profound intellectual property legal knowledge, good political literacy and professional ethics, and be able to skillfully apply legal theoretical knowledge to intellectual property practice. Strengthen the training of public lawyers, and all regions should focus on training public lawyers with rich practical experience in intellectual property rights to improve the level of intellectual property legal services.

Fourth, key projects

(a) intellectual property personnel training base construction project. Set up a number of national intellectual property talent training bases to cultivate high-level compound talents. Explore the training mode of intellectual property talents in Industry-University-Research, which is jointly participated by universities, enterprises and intellectual property service institutions, establish a demand-oriented joint training mechanism for intellectual property talents, and form a platform for intellectual property talents training and exchange. Implement the dynamic adjustment of the national intellectual property training base, further optimize the layout of the base and improve the quality of the base. Create a number of demonstration intellectual property personnel training programs, promote the "progressive" series of training, and improve the project quality evaluation mechanism and achievement promotion mechanism. All regions should strengthen the management of local intellectual property training bases, and form a clear-cut base system with national bases.

(two) the construction project of intellectual property network training course. Actively explore new forms and methods of intellectual property training, adapt to the development trend of digitalization, networking and intelligence, focus on promoting the construction of online course system of China intellectual property distance education platform, launch a number of online excellent courses, build an open and shared intellectual property online course database, and improve the scientificity, standardization and effectiveness of online training. Guide local governments to carry out online training for administrative personnel and realize full-time rotation training. All regions should develop a number of courses with intellectual property characteristics in light of local work practice.

(three) intellectual property talents highland construction project. Combine the national and regional major strategies, highlight the characteristics, and guide the development of regional intellectual property talents by classification. Promote the construction of high-level intellectual property talents highland in Beijing, Shanghai and Guangdong-Hong Kong-Macao Greater Bay Area, carry out regional and industrial demand forecasting of intellectual property talents, explore and draw a map of talent supply status and future demand, and form an annual statistical report on intellectual property talents. Encourage and support the construction of a platform to attract and gather talents in central cities where high-level intellectual property talents are concentrated. Carry out the work related to the service area and industrial development of intellectual property experts. Promote the docking of intellectual property talents with preferential policies for regional talents.

(four) the construction project of intellectual property think tank expert database. Give full play to the role of the National Intellectual Property Expert Advisory Committee, and provide strategic advice for the overall, key and forward-looking issues of intellectual property development. China National Intellectual Property Administration research institutions should strengthen exchanges with universities, scientific research institutions and local intellectual property management departments, and carry out theoretical and practical research. Encourage and guide universities and social institutions to build intellectual property think tanks. All regions should strengthen the construction of intellectual property characteristic think tanks and build a multi-level and high-level intellectual property think tank system. Refine the classification of intellectual property expert database and improve the categories of experts in geographical indications, trade secrets, traditional knowledge, traditional culture and other fields. Effectively streamline the talent hat, optimize and integrate all kinds of intellectual property talent plans, strengthen the training and use of intellectual property leading talents and high-level talents, and build a team of "high, precise and sharp" intellectual property talents.

(five) the evaluation project of intellectual property titles. Actively promote the reform of the title system of intellectual property rights, support local governments to formulate evaluation standards and conditions for intellectual property professional and technical personnel, and scientifically determine the evaluation content to meet the evaluation needs of professional and technical personnel at different levels. Strengthen the information management of professional title evaluation, and establish a national intellectual property title evaluation service network platform. Where conditions permit, it is necessary to establish an intellectual property senior title evaluation committee, innovate the title evaluation mechanism, and enrich the title evaluation methods.

(six) intellectual property professional degree setting support projects. Fully understanding the professional degree education is an important way to train talents who are in urgent need in the construction of a strong intellectual property country, speeding up the establishment of intellectual property professional degrees, giving full play to the important role of colleges and universities in the cultivation of intellectual property talents, and meeting the needs of the construction of a strong intellectual property country for high-level talents. Scientifically set up the curriculum system of intellectual property professional degree, closely combine the basic theoretical study of intellectual property with practical skills training, and focus on cultivating the practical ability of intellectual property talents. Promote the joint construction of intellectual property colleges and research institutes in the central region and explore new ways to train intellectual property talents.

V. Organization and implementation

(1) Strengthen organizational leadership. The national intellectual property system should attach great importance to the work of intellectual property talents, strengthen organizational leadership, improve the working mechanism, take effective measures, and fully implement the tasks of talent planning and deployment. The leading departments of various tasks should formulate implementation plans and promotion plans. Intellectual property management departments in various regions should combine local work practice, refine objectives and tasks, and clarify work responsibilities.

(2) Increase investment in resources. Adhere to the concept of giving priority to the development of talents, increase investment in intellectual property personnel training, strive for the support of special state funds, strengthen the protection of urgently needed talents and key projects, and comprehensively strengthen support for talent work from the aspects of manpower, financial resources and policies.

(3) create a good environment. Vigorously publicize the significance of implementing talent planning, and deeply interpret the guiding ideology, basic principles, objectives and tasks. Strengthen the positive encouragement of talent growth, create a development environment conducive to the entrepreneurship of talent officers, let the cause inspire talents, and let talents achieve their careers.

(4) Pay close attention to the implementation of the work. Strengthen the tracking and monitoring of the implementation of talent planning, do a good job in the evaluation of talent planning implementation, sum up and popularize typical experiences and practices, find problems in the implementation of talent planning in time and study and solve countermeasures, and earnestly strengthen supervision and inspection to ensure the implementation of tasks.