Xinhua News Agency, Beijing, December 8th Question: Looking at the new trend of China’s economic work in 2024 from Politburo meeting of the Chinese Communist Party.

Xinhua News Agency "Xinhua Viewpoint" reporter

On December 8th, the Political Bureau of the Communist Party of China (CPC) Central Committee held a meeting to analyze and study the economic work in 2024, clearly put forward "the general tone of striving for progress while maintaining stability", and emphasized "consolidating and strengthening the economic recovery to a good trend, and continuously promoting the effective improvement of the quality and reasonable growth of the economy". A series of important arrangements conveyed the new trend of economic work in 2024.

This year’s economic recovery is improving, and next year will usher in a crucial year for the implementation of the 14 th Five-Year Plan.

This year is the first year of fully implementing the spirit of the 20th National Congress of the Communist Party of China, and the year of economic recovery and development after three years of epidemic prevention and control in COVID-19.

At present, the situation facing China’s development is complicated, the unfavorable factors in the international political and economic environment are increasing, and domestic cyclical and structural contradictions are superimposed.

"Resist external pressure and overcome internal difficulties", "China’s economic recovery is improving" and "take solid steps to build a socialist modern country in an all-round way" … … Politburo meeting of the Chinese Communist Party summed up this year’s economic performance.

Under the complicated and severe situation, this year’s economic operation and achievements in economic work are hard-won, which fully proves the correctness and foresight of the CPC Central Committee’s judgment on the situation and related decisions. Looking forward to the new year, General Secretary of the Supreme Leader also made a judgment at the symposium of non-party people held on December 6: "China’s economic recovery is still at a critical stage."

The year 2024 marks the 75th anniversary of the founding of People’s Republic of China (PRC), and is a crucial year for the implementation of the 14th Five-Year Plan. It is very important to do a good job in economic work.

"Intensify macro-control", "Effectively enhance economic vitality, prevent and resolve risks, and improve social expectations", "Consolidate and strengthen the economic recovery to a good trend" and "continuously promote the effective improvement of the quality and reasonable growth of the economy" … … Politburo meeting of the Chinese Communist Party has made a series of arrangements for next year’s economic work.

The head of the National Economic Comprehensive Department of the National Development and Reform Commission said that the "three overall plans" put forward by the meeting are important principles to be grasped in economic work next year. Make overall plans to expand domestic demand and deepen supply-side structural reform, organically combine the two, enhance the endogenous power and reliability of domestic large-scale circulation, and improve the quality and level of international circulation. Coordinate new urbanization and overall rural revitalization, unremittingly do a good job in the work of agriculture, rural areas and farmers, put the urbanization of agricultural transfer population in a more prominent position, and promote the integrated development of urban and rural areas. Coordinate high-quality development and high-level security, firmly hold high-quality development, continuously and effectively prevent and resolve risks in key areas, strengthen national security capacity building, and ensure a new development pattern with a new security pattern.

We must persist in striving for progress in stability, promoting stability through progress, and breaking first.

Politburo meeting of the Chinese Communist Party pointed out that next year, we should persist in striving for progress from stability, promoting stability through progress, establishing first and then breaking, strengthen countercyclical and cross-cyclical adjustment of macro policies, and continue to implement a proactive fiscal policy and a prudent monetary policy.

"The key to insisting on striving for progress in stability, promoting stability through progress, and breaking first is to grasp the dialectical relationship contained in it." The head of the National Economic Comprehensive Department of the National Development and Reform Commission said that all work needs to respect the law. Promote "progress" on the basis of "stability" and achieve "stability" through "progress" in economic structure, development quality and major reforms. It is also necessary to grasp the order of "establishing" and "breaking", otherwise it will affect the overall situation of economic development, which is also an important methodology of economic work.

Dong Yu, executive vice president of Tsinghua University China Development Planning and Research Institute, believes that there are both short-term and long-term problems in the current economic operation. Judging from the deployment of the conference, next year’s macro policies will be more precise, more additions will be made, more proactive support policies will be adopted, and problems will be solved by development methods to further boost confidence.

In addition, the meeting stressed that a proactive fiscal policy should be moderately strengthened, quality improved and efficiency improved, and a prudent monetary policy should be flexible, moderate, accurate and effective.

Since the beginning of this year, China has continued to implement a proactive fiscal policy and a prudent monetary policy, intensified macro-policy control, strengthened coordination and cooperation of various policies, strived to promote the overall economic recovery and solidly promoted high-quality development.

"The meeting is clear ‘ Moderate afterburner ’ At the same time, emphasize ‘ Improve quality and increase efficiency ’ It will help strengthen the pertinence of fiscal policy. " Yang Zhiyong, director of the Finance and Taxation Research Center of China Academy of Social Sciences, said that in the context of China’s continuous implementation of a proactive fiscal policy in recent years, next year’s fiscal policy will continue to exert its strength, remain positive, improve quality and efficiency, and play a more precise and targeted role.

Ceng Gang, director of the Shanghai Finance and Development Laboratory, believes that counter-cyclical and inter-cyclical adjustments should be made through a prudent monetary policy, the total amount of money and credit and the scale of social financing should be reasonably increased, and structural monetary policy tools should be used well to achieve "flexibility, moderation, accuracy and effectiveness" and effectively support the steady growth of the real economy.

Politburo meeting of the Chinese Communist Party proposed to strengthen the consistency of macro-policy orientation and strengthen economic propaganda and public opinion guidance.

"Strengthening the consistency of macro-policy orientation can not only improve the policy effect, but also help stabilize market expectations." Ceng Gang said, on the one hand, it is necessary to realize the continuity of the old and new policies; on the other hand, it is necessary to do a good job in the coordination of fiscal, monetary, industrial and regulatory policies, so as to form a joint force to jointly promote high-quality development.

Accelerate the construction of a new development pattern and continuously inject strong impetus into high-quality development.

The key to building a new development pattern is to realize the unimpeded economic cycle, which mainly depends on whether the supply and demand ends are strong, overall matched, dynamically balanced and benign. In this regard, Politburo meeting of the Chinese Communist Party proposed "expanding domestic demand as a whole and deepening supply-side structural reform" and made a series of important arrangements.

Focusing on the supply side, the meeting proposed that scientific and technological innovation should lead the construction of a modern industrial system and enhance the resilience and safety level of the industrial chain supply chain.

"At present, a new round of scientific and technological revolution and industrial transformation is developing in depth, with an unprecedented range of radiation and influence. We must persist in taking scientific and technological innovation as the main force, lead industrial transformation with scientific and technological innovation, upgrade industrial energy level, make up shortcomings and forge long boards, vigorously cultivate new pillar industries, constantly open up new fields and new tracks for development, and shape new kinetic energy and new advantages for development. " Dong Wei said.

Focusing on the demand side, the meeting proposed that efforts should be made to expand domestic demand and form a virtuous circle in which consumption and investment promote each other.

The head of the National Economic Comprehensive Department of the National Development and Reform Commission said that on the one hand, to meet consumer demand, especially the people’s growing needs for a better life, it is necessary to continuously improve the effective supply capacity and quality, and to improve supply requires effective investment; On the other hand, in the process of transforming investment into physical workload, it will also effectively drive income increase and consumption expansion through chain transmission such as the purchase of goods or services, thus forming a virtuous circle.

To achieve a virtuous circle of the national economy, it is inseparable from further deepening reform and opening up. The meeting proposed to deepen the reform of key areas and continuously inject strong impetus into high-quality development. It is necessary to expand high-level opening to the outside world and consolidate the basic disk of foreign trade and foreign investment.

Grasping the bottom line of people’s livelihood and ensuring the timely and full payment of migrant workers’ wages

People’s happiness and well-being is the ultimate goal of promoting high-quality development. The more complicated and severe the economic situation is, the more we should focus on people’s livelihood concerns and grasp the bottom line of people’s livelihood.

Politburo meeting of the Chinese Communist Party pointed out that we should do our best and do what we can to ensure and improve people’s livelihood.

"At present, China is at a critical stage of economic recovery. Effectively safeguarding and improving people’s livelihood is the general direction, and it is a necessary principle to persist in doing our best and doing what we can. We must continue to pay attention to key industries and key populations, and all parties should work together to create a better life. " Feng Wenmeng, a researcher at the State Council Development Research Center, said.

The meeting also stressed that it is necessary to ensure the supply and price stability of important livelihood commodities during the "two festivals", ensure that the wages of migrant workers are paid in full and on time, care for the production and life of people in difficulty, thoroughly implement the responsibility system for production safety, and protect the lives and property safety and health of the people.

Feng Wenmeng said that a series of arrangements for this meeting are related to the people’s livelihood and well-being. In particular, ensuring the supply of "rice bags" and "vegetable baskets" during the "two festivals" is related to whether the people can live a good year. It is necessary to put the work of ensuring supply and stabilizing prices in place and firmly grasp the bottom line of various people’s livelihood security.

At the end of the year and the beginning of the year, the problem of wage arrears is prone to high incidence. Su Hainan, a special researcher in china association for labour studies, said that this time, Politburo meeting of the Chinese Communist Party put forward clear requirements on ensuring the wages of migrant workers, which reflected a high degree of concern for people’s livelihood. In the next step, the key is to implement the meeting arrangements, solidly carry out the special campaign to eradicate wage arrears in winter, promote the verified cases of wage arrears for migrant workers to be settled as soon as possible, and severely punish illegal and illegal acts such as malicious wage arrears to effectively safeguard the legitimate rights and interests of migrant workers.

One point for deployment and nine points for implementation. The meeting stressed that it is necessary to uphold and strengthen the overall leadership of the party and implement the major decision-making arrangements of the CPC Central Committee on economic work with high quality.

Experts said that China is currently in a critical period of economic recovery and industrial transformation and upgrading. Under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, China is fully qualified and capable of overcoming difficulties and challenges and promoting sustained and healthy economic development by putting all decision-making arrangements in place with high quality and giving full play to its own advantages. (Reporter Chen Weiwei, Pan Dexin, Zhao Wenjun, Pan Jie)

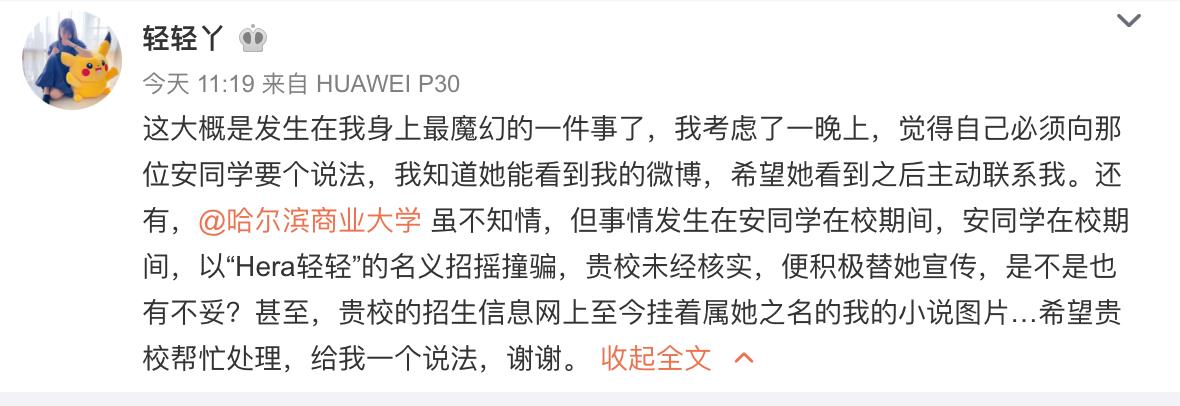

?

?

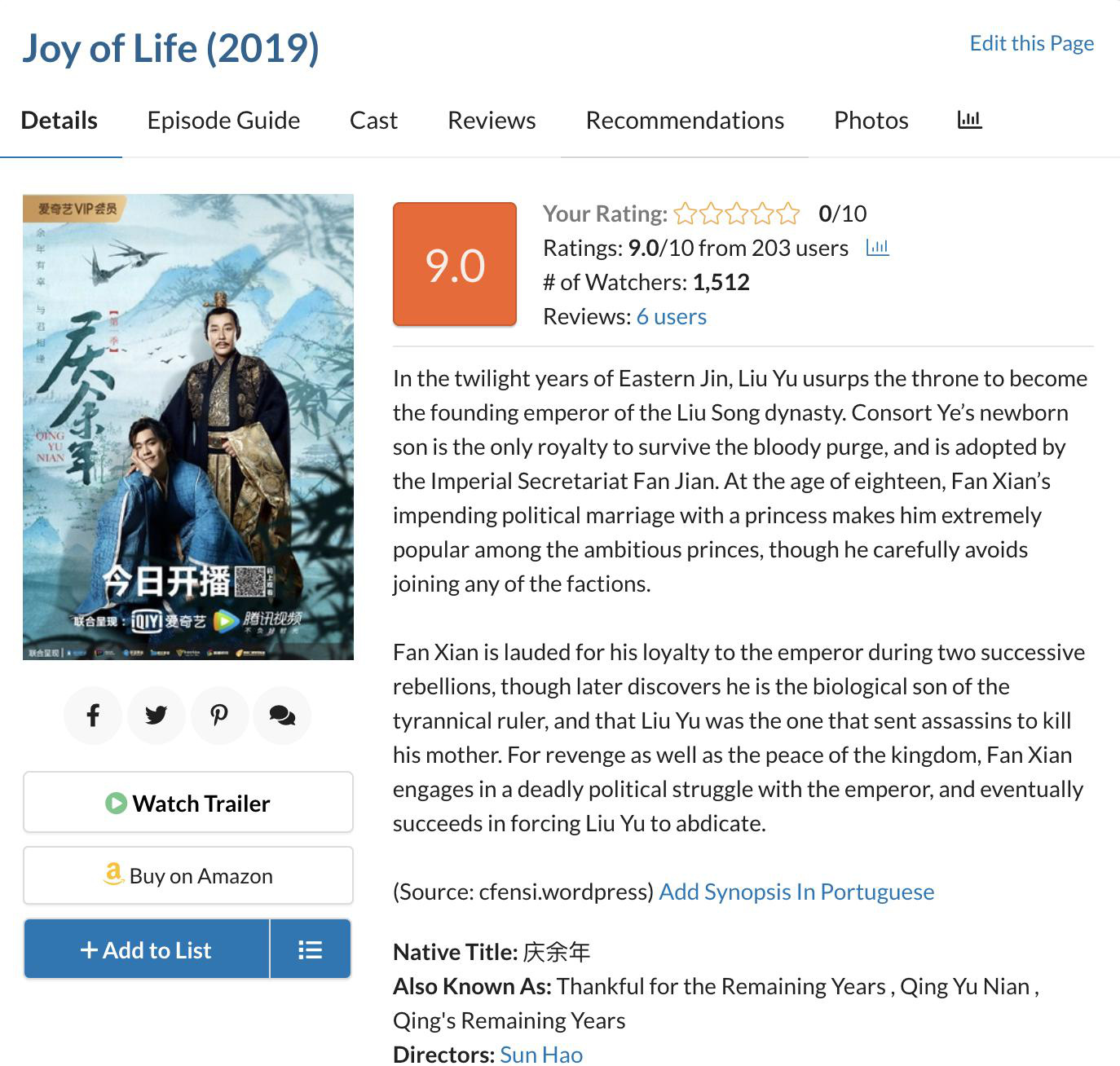

Mydramalist Rating

Mydramalist Rating